Adrian Owens

Adrian is the County Councillor for West Lancashire East and Borough Councillor for the Rural South Ward. His email address is adrian.owens@lancashire.gov.uk

Adrian was elected a councillor for the Rural South ward in May 2024. Previous to that he was a councillor in Derby Ward covering part of Ormskirk and Westhead village for 24 years until 2023 when the ward disappeared with boundary changes. He was Deputy Leader of West Lancashire Borough Council between 2008 and 2014.

As the Borough council’s Regeneration portfolio holder he helped secure investment in Skelmersdale, Ormskirk and Burscough’s centres. While Finance Portfolio Holder he reduced the real level of council tax and expanded services, while in housing he approved major investments to 1 in 4 council house properties and spearheaded the major estate revival at Firbeck while giving extra priority for council housing to people who work and volunteer.

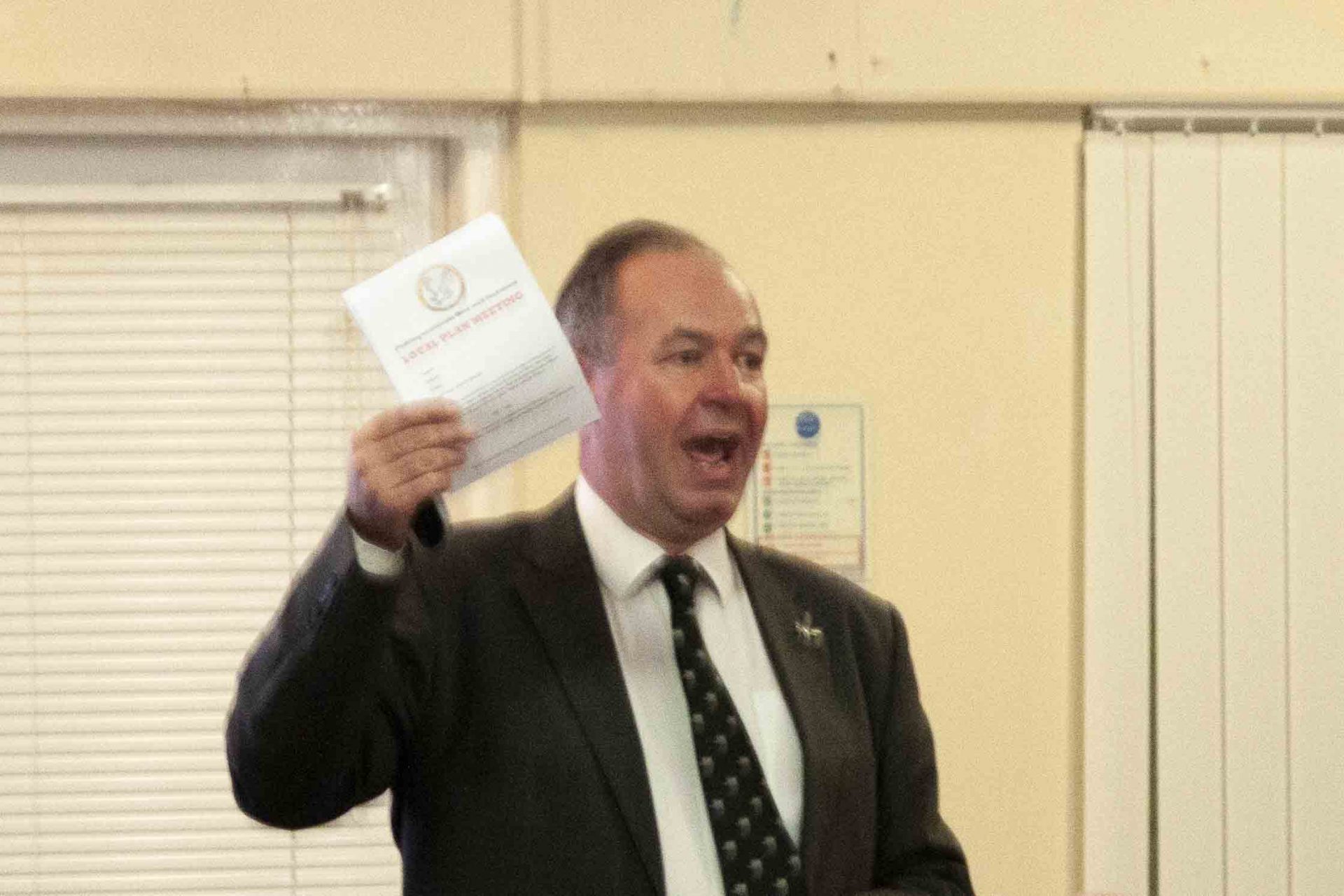

He was responsible for initiating the Freedom of the Borough for the Duke of Lancaster’s Regiment. He promotes Ormskirk as a market town and was at the forefront of the opposition to Labour’s ill-conceived plans in 2018 to build 16000 houses mostly on the green belt (pictured at a public meeting organised by OWL here). As finance portfolio holder he provided funds for a changing room refurbishment at Park Pool; new roof at Nye Bevan Pool; massive improvements at Coronation Park and for a new children’s play area in Westhead.

Away from the council, Adrian has been a trustee of the Birchwood Centre in Skelmersdale for 15 years. The Centre provides accommodation and support to young people in crisis. Adrian was Chairman of Governors at Our Lady and All Saints Primary School in Parbold for a number of years and steered the school to an ‘Outstanding’ OFSTED category. Adrian has run a health and safety consultancy for more than 20 years but is gradually winding down the business to devote more time to other interests.

I am a supporter of open and transparent politics. I believe that politics is about public service.

I place a proportion of my councillor allowances in a charity fund. If you would like to suggest a local charity for a donation from this fund, please contact me. Ormskirk’s Wellbeing Centre for Older People; Ormskirk Civic Hall; Praise in the Park; West Lancashire Debt Advice; Appleton Fields Association; Queenscourt Hospice; vulnerable people being faced with eviction have all received donations in the past.

I waived my entitlement to a special responsibility allowance in 2019/20 and 2020/21 as I did not believe that the workload justified the payment. This saved taxpayers nearly £5000.

Tax year 2024/25

Taxable Gross Allowance Received: £4146

Charitable Donations through Give as You Earn: £1670

Expenses claimed: Nil

Tax year 2023/24

Taxable Gross Allowance Received: £663

Charitable Donations through Give as You Earn: £200

Expenses claimed: Nil

Tax year 2022/23

Taxable Gross Allowance Received: £5831

Charitable Donations through Give as You Earn: £2400

Expenses claimed: Nil

Tax year 2021/22

Taxable Gross Allowance Received: £5942.36

Charitable Donations through Give as You Earn: £2315

Expenses claimed: Nil

Tax year 2020/21

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2020/21

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2019/20

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2018/19

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2017/18

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2016/17

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2015/16

Taxable Gross Allowance Received: £3462

Charitable Donations through Give as You Earn: £1380

Expenses claimed: Nil

Tax year 2014/15

Taxable Gross Allowance Received: £5144.43

Charitable Donations through Give as You Earn: £1130

Expenses claimed: Nil

Tax year 2013/14

Taxable Gross Allowance Received: £9225

Charitable Donations through Give as You Earn: £2880

Expenses claimed: Nil

Tax year 2012/13

Taxable Gross Allowance Received: £9225

Charitable Donations through Give as You Earn: £2880

Expenses claimed: Nil

Other: June 2012 – Attended a dinner with drink and entertainment at the Manchester Hilton Hotel paid for by Tunstall. Paid for own travel expenses.

Tax year 2011/12

Taxable Gross Allowance Received: £9225

Charitable Donations through Give as You Earn: £2880

Expenses claimed: £162.10 for 2nd class advanced return train fare to London and one night bed and breakfast in hotel to attend a training course on developments in Local Government Housing Finance having taken on role of Housing Finance Portfolio Holder and before the major changes to housing finance in April 2012

Tax year 2010/11

Taxable Gross Allowance Received: £9225

Charitable Donations through Give as You Earn: £2880

Expenses claimed: Nil

Tax year 2009/10

Taxable Gross Allowance Received: £9225

Charitable Donations through Give as You Earn: £2880

Expenses claimed: Nil

Tax year 2008/09

Taxable Gross Allowance Received: £9161.79

Charitable Donations through Give As You Earn: £2320.00

Expenses claimed: Nil

Other: July 2008 – Attended Buckingham Palace Garden Party with my wife, representing West Lancashire District Council. Two Labour councillors also attended.

Two nights bed and breakfast at City Inn, Westminster and chauffeured transport to London and to the Palace provided by West Lancashire District Council. All other meal, transport and incidental expenses covered from personal account. Other councillors will attend this event in future years.

November 2008 – Attended Speed Reading course run by Northwest Employers. Cost: £99

Tax year 2007/08

Taxable Gross Allowance Received: £7416.57

Charitable Donations through Give As You Earn: £1920.00

Expenses claimed: Nil

Other: Not applicable